UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

x | Definitive Proxy Statement | |

¨ | Definitive Additional Materials | |

¨ | Soliciting Material Pursuant to Section 240.14a-12 | |

CUMULUS MEDIA INC.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x | No fee required. | |||

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

N/A | |||

| (2) | Aggregate number of class of securities to which transaction applies:

N/A | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

N/A | |||

| (4) | Proposed maximum aggregate value of transaction:

N/A | |||

| (5) | Total fee paid:

N/A | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fees was paid previously. Identify the previous filing by registration statement number or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

N/A | |||

| (2) | Form, Schedule or Registration Statement No.:

N/A | |||

| (3) | Filing Party:

N/A | |||

| (4) | Date Filed:

N/A | |||

Cumulus Media Inc.

Annual Meeting of Stockholders

May 10, 201322, 2014

Notice of Meeting and Proxy Statement

3280 Peachtree Road, N.W.

Suite 2300

Atlanta, Georgia 30305

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 10, 201322, 2014

To the Stockholders of Cumulus Media Inc.:

The 20132014 Annual Meeting of Stockholders of Cumulus Media Inc., a Delaware corporation (“Cumulus Media,” “we” or the “Company”), will be held at the Company’s offices, 3280 Peachtree Road, N.W., Atlanta, Georgia 30305, in the boardroom located on the 23rd floor, on May 10, 201322, 2014 at 9:00 a.m., local time, for the following purposes:

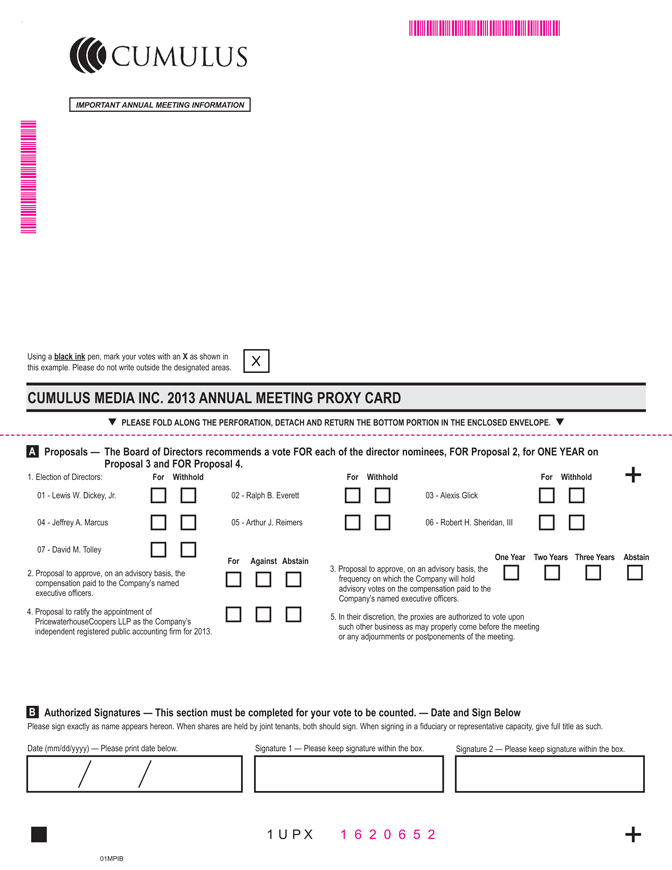

(1) to elect seven (7) directors to serve until the next annual meeting of stockholders and until their successors are elected and qualified;

(2) to approve, on an advisory basis, the compensation paid to the Company’s named executive officers;

(3) to approve, on an advisory basis, the frequency on which the Company will hold future advisory votes on the compensation paid to the Company’s named executive officers;

(4) to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2013;2014; and

(5)(4) to transact such other business as may properly come before the annual meeting or any postponement or adjournment thereof.

Only holders of record of shares of the Company’s Class A common stock or Class C common stock at the close of business on April 5, 20134, 2014 are entitled to notice of, and to vote at, the annual meeting or any postponement or adjournment thereof.

Holders of a majority of the outstanding voting power represented by the shares of the Company’s Class A common stock and Class C common stock, voting together as a single class, must be present in person or by proxy in order for the meeting to be held. Our Board of Directors recommends that you voteFOReach of the director nominees,FOR the approval, on an advisory basis, of the compensation paid to the Company’s named executive officers, forONE YEAR as the preferred frequency on which to hold the advisory vote on executive compensation andFORthe ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2013.2014. Therefore, we urge you to date, sign and return the accompanying proxy card in the enclosed envelope, or vote your shares by telephone or via the Internet, as soon as possible, whether or not you expect to attend the annual meeting in person. If you attend the annual meeting and wish to vote your shares in person, you may do so by validly revoking your proxy at any time prior to the vote.

This notice, the proxy statement and the accompanying proxy card are being distributed to stockholders and made available on the Internet commencing on or about April 12, 2013.21, 2014.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 10, 201322, 2014

The proxy statement and the Annual Report on Form 10-K for the fiscal year ended December 31, 20122013 are available at www.edocumentview.com/CMLS. If you need directions to the 20132014 Annual Meeting of Stockholders, please call (404) 949-0700.

Lewis W. Dickey, Jr.

Chairman, President and Chief Executive Officer

April 12, 201321, 2014

- i -

INFORMATION REGARDING THE ANNUAL MEETING

Proxy Statement; Date, Time and Place of Annual Meeting

We are furnishing this proxy statement in connection with the solicitation of proxies by our Board of Directors for use at our 20132014 annual meeting of stockholders (the “annual meeting”) to be held on May 10, 2013,22, 2014, at 9:00 a.m., local time, at our offices, 3280 Peachtree Road, N.W., Atlanta, Georgia 30305, in the boardroom located on the 23rd floor, or at any adjournment or postponement of that meeting. At the annual meeting, stockholders will be asked to consider and vote on the items of business listed and described in this proxy statement. This proxy statement and the accompanying proxy card are first being distributed to our stockholders and made available on the Internet on or about April 12, 2013.21, 2014.

Record Date; Quorum; Outstanding Common Stock Entitled to Vote

All holders of record of our Class A common stock and our Class C common stock as of April 5, 20134, 2014 (the “Record Date”) are entitled to receive notice of, and to vote at, the annual meeting. If your shares are held in “street name” through a bank, broker or other nominee, you must obtain a proxy card from your bank, broker or other nominee in order to be able to vote your shares at the annual meeting. As of the Record Date, there were 159,653,875213,713,494 shares of our Class A common stock outstanding and 644,871 shares of our Class C common stock outstanding. Each share of Class A common stock outstanding is entitled to one vote for each of the seven director nominees and one vote on each other matter to be acted on at the annual meeting, and each share of Class C common stock is entitled to ten votes for each of the seven director nominees and ten votes on each other matter to be acted on at the annual meeting. As a result ofOn the Record Date, there were 220,162,204 votes represented by the outstanding shares representing 166,102,585 votes outstanding.of Class A common stock and Class C common stock. The presence, in person or by proxy, of holders of a majority of the voting power represented by our outstanding shares of our Class A common stock and our Class C common stock, voting together as a single class, is required to constitute a quorum for the transaction of business at the annual meeting.

Abstentions and “broker non-votes” will be treated as present for purposes of determining a quorum. A “broker non-vote” occurs when a registered holder (such as a bank, broker or other nominee) holding shares in “street name” for a beneficial owner does not vote on a particular proposal because the registered holder does not have discretionary voting power for that particular proposal and has not received voting instructions from the beneficial owner. Banks, brokers or other nominees that have not received voting instructions from their clients cannot vote on their clients’ behalf on the election of directors or the approval, on an advisory basis, of the compensation paid to our named executive officers, (sometimeswhich is sometimes referred to as the “advisory vote on executive compensation” or the “say-on-pay” vote) or the advisory vote, on the frequency of the advisory vote on executive compensation (sometimes referred to as the “say-when-on-pay” vote), but may (but are not required to) vote their clients’ shares on the proposal to ratify the appointment of our independent registered public accounting firm.

If a quorum is not present at the scheduled time of the annual meeting, the chairman of the meeting may adjourn or postpone the annual meeting until a quorum is present. The time and place of the adjourned or postponed annual meeting will be announced at the time the adjournment or postponement is taken, and, unless such adjournment or postponement is for more than 30 days, no other notice will be given. An adjournment or postponement will have no effect on the business that may be conducted at the annual meeting.

Voting Rights; Vote Required for Approval

Each share of Class A common stock outstanding is entitled to one vote for each of the seven director nominees and one vote on each other matter to be acted on at the annual meeting, and each share of Class C common stock is entitled to ten votes for each of the seven director nominees and ten votes on each other matter to be acted on at the annual meeting. Cumulative voting for director nominees is not allowed.

The affirmative vote of a majority of the votes entitled to be cast and represented at the annual meeting is required to elect each director nominee, to approve the advisory vote on executive compensation to approve the frequency of the advisory vote on executive compensation and to ratify the

- 1 -

appointment of our independent registered public accounting firm for 2013.2014. Votes withheld from the election of directors and abstentions with

- 1 -

respect to the approval of the advisory vote on executive compensation, the frequency of the advisory vote on executive compensation and the ratification of the appointment of our independent registered public accounting firm for 20132014 will have the same effect as a vote against such director or such proposal, but broker non-votes are not considered to be votes cast and will have no effect on the outcome of the vote on the election of directors.directors or the approval of the advisory vote on executive compensation.

Voting and Revocation of Proxies

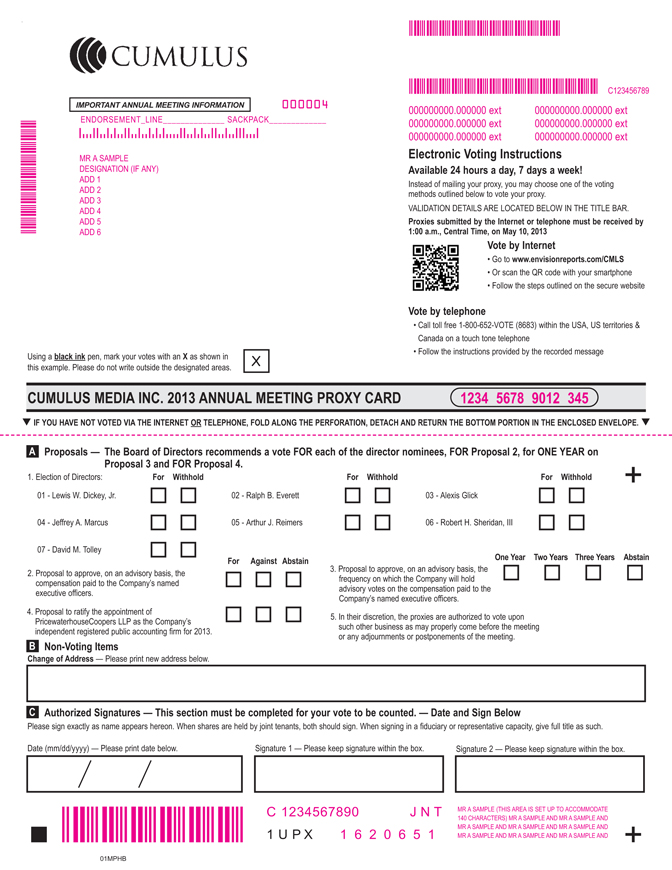

A proxy is a legal designation of another person to vote stock you own. That other person is called a proxy. If you designate someone as your proxy in a written or electronic document, that document is also called a proxy, a proxy card or a form of proxy. A proxy card for you to use in voting at the annual meeting accompanies this proxy statement. You may also vote by telephone or via the Internet as follows:

by telephone: call toll free 1-800-652-VOTE (8683) and follow the instructions provided by the recorded message; or

via the Internet: visit www.envisionreports.com/CMLS and follow the steps outlined on the secure website.

All properly executed proxies that are received prior to, or at, the annual meeting and not revoked (and all shares properly voted by telephone or via the Internet) will be voted in the manner specified. If you execute and return a proxy card, and do not specify otherwise, the shares represented by your proxy will be votedFOReach of the director nominees,FOR the advisory approval of executive compensation forONE YEAR as the preferred frequency for the advisory vote on executive compensation andFORthe ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2013.2014.

If you have given a proxy or voted by telephone or via the Internet pursuant to this solicitation, you may nonetheless revoke that proxy or vote by attending the annual meeting and voting in person. In addition, you may revoke any proxy you give before the annual meeting by voting by telephone or via the Internet at a later date (in which case only the last vote will be counted) prior to 1:00 a.m. Central Time on May 10, 2013,22, 2014, by delivering a written statement revoking the proxy or vote or by delivering a duly executed proxy bearing a later date to Richard S. Denning, Corporate Secretary, at our principal executive offices, 3280 Peachtree Road, N.W., Suite 2300, Atlanta, Georgia 30305, so that it is received prior to the annual meeting, or by voting at the annual meeting itself prior to the closing of the polls. If you have executed and delivered a proxy to us or voted by telephone or via the Internet, your attendance at the annual meeting will not, by itself, constitute a revocation of your proxy.

Solicitation of Proxies and Householding

We will bear the cost of the solicitation of proxies. We will solicit proxies initially by mail. Further solicitation may be made by our directors, officers and employees personally, by telephone, facsimile, e-mail or otherwise, but they will not be compensated specifically for these services. Upon request, we will reimburse brokers, dealers, banks or similar entities acting as nominees for their reasonable expenses incurred in forwarding copies of the proxy materials to the beneficial owners of the shares of common stock they hold of record.

From time to time, we, may and if you hold your shares in street name, your bank, broker or other nominee, may participate in the practice of “householding” proxy soliciting material. This means that if you reside in the same household as other stockholders of record or beneficial owners of our common stock, you may not receive your own copy of our proxy materials, even though each stockholder receives his or her own proxy card. If your household received one set of proxy materials and you are a stockholder of record who would like to receive additional copies of our proxy materials, you may request a duplicate set by contacting our Corporate Secretary at our principal executive offices, 3280 Peachtree Road, N.W., Suite 2300, Atlanta, Georgia 30305 or at the following telephone number: (404) 949-0700. If you share an address with other stockholders of record and your

- 2 -

household received multiple sets of proxy materials, and you would like for your household to receive a single copy of our proxy materials, you may make such a request by contacting our Corporate Secretary at our principal

- 2 -

executive offices listed above. If you hold your shares in street name, please contact your bank, broker or other nominee directly to request a duplicate set of proxy materials or to reduce the number of copies of our proxy materials that are sent to your household.

Other Matters

Except for the votes on the proposals described in this proxy statement, no other matter is expected to come before the annual meeting. If any other business properly comes before the annual meeting, the persons named as proxies will vote in their discretion to the extent permitted by law.

- 3 -

PROPOSAL NO. 1: ELECTION OF DIRECTORS

As described below, the size of our board of directors (the “Board of Directors” or the “Board”) is currently set at seven members. All sevenSix of the director nominees are currently directors. Pursuant to our Third Amended and Restated Certificate of Incorporation (the “Charter”) and our Amended and Restated By-laws (the “By-laws”), directors are elected or appointed to a term which expires at the next successive annual meeting of stockholders and when their successors are elected and qualified. Each director nominee was elected by our stockholders at our 20122013 annual meeting of stockholders, except for Alexis Glick,Brian Cassidy, who was appointedhas been designated by Crestview Radio Investors, LLC (“Crestview”) to succeed Arthur J. Reimers who is retiring from the Board when his current term of office expires at the annual meeting, as one of Crestview’s designees on the Board in February 2013 followingaccordance with the retirement from our Board of Directors of Eric P. Robison, who had served as a memberterms of the Board of Directors since 1999.Stockholders’ Agreement (defined below).

The director nominees have all been nominated for election by our Board of Directors, upon the recommendation of a majority of our independent directors. If elected, each of the director nominees will serve until the 20142015 annual meeting of stockholders or until each is succeeded by another qualified director who has been elected. Our Board of Directors has no reason to believe that any of these individuals will be unable or unwilling to serve as directors. If for any reason any of these individuals becomes unable or unwilling to serve before the annual meeting, it is expected that the persons named in the proxy will vote for the election of such other persons as our Board of Directors may recommend.

Pursuant to a stockholders’ agreement (the “Stockholders’ Agreement”) entered into in September 2011, in connection with completing our acquisition of Citadel Broadcasting Corporation (“Citadel”), by us and BA Capital Company, L.P. (“BA Capital”) and Banc of America Capital Investors SBIC, L.P. (“BACI”) (together, the “BofA Stockholders”), Blackstone FC Communications Partners L.P. (“Blackstone”), Lewis W. Dickey, Jr., John W. Dickey, David W. Dickey, Michael W. Dickey, Lewis W. Dickey, Sr. and DBBC, L.L.C. (collectively, the “Dickeys”), Crestview, Radio Investors, LLC (“Crestview”), MIHI LLC and UBS Securities LLC, the size of the Board of Directors is set at seven members. The Stockholders’ Agreement provides that Crestview has the right to designate two individuals for nomination to the Board of Directors, and each of the Dickeys and the BofA Stockholders and Blackstone hascurrently have the right to designate one individual for nomination to the Board of Directors. The Stockholders’ Agreement also provides that the other twothree positions on the Board of Directors will be filled by individuals selected and nominated by the Board of Directors, each of whom must meet applicable independence criteria. Further, the parties to the Stockholders’ Agreement (other than the Company) have agreed to support the director nominees who are designated by the relevant stockholders and are presented to the Company’s stockholders for approval at stockholder meetings. Each stockholder party’s respective director nomination rights under the Stockholders’ Agreement will generally survive for so long as that stockholder continues to own a specified percentage of the Company’s stock, subject to certain exceptions. Messrs. Marcus and Reimers are currently Crestview’s designees to our Board of Directors and Mr. Tolley is Blackstone’s designeeCassidy has been designated by Crestview and nominated by the Board to ourreplace Mr. Reimers upon this retirement from the Board, of Directors, Mr. Sheridan is the BofA Stockholders’ designee to our Board of Directors, and Mr. Lewis W. Dickey, Jr., our Chairman, President and Chief Executive Officer, is the Dickeys’ designee to our Board of Directors. Mr.Messrs. Everett and Tolley (who had served as the designee of Blackstone pursuant to the Stockholders’ Agreement prior to the expiration in early 2014 of Blackstone’s right to make such designation), Ms. Glick, have been selected and nominated by our Board of Directors and each has been determined to meet the applicable independence criteria.

Detailed information about each of the director nominees is provided below.

Lewis W. Dickey, Jr., age 51,52, is our Chairman, President and Chief Executive Officer. Mr. Dickey has served as Chairman, President and Chief Executive Officer since December 2000. Mr. Dickey was one of our founders and initial investors, and served as Executive Vice Chairman from March 1998 to December 2000.

Mr. Dickey is a nationally regarded consultant on radio strategy and the author ofThe Franchise — Building Radio Brands, published by the National Association of Broadcasters, one of the industry’s leading texts on

- 4 -

competition and strategy. Mr. Dickey also serves as a member of the National Association of Broadcasters Radio board of directors. Mr. Dickey is the brother of John W. Dickey, our Executive Vice President and Co-Chief Operating Officer.

- 4 -

Mr. Dickey has over 2930 years of experience in the radio broadcasting industry in a variety of strategic, operational and financing areas. As a founder of Cumulus Media, Mr. Dickey was instrumental in our development and growth. His service as our Chairman and Chief Executive Officer over the past elevenfourteen years has resulted in his having a unique level of knowledge of the opportunities and challenges associated with our business. Among other things, he brings to our Board of Directors his extensive background in station acquisitions, integration and management. Mr. Dickey’s familiarity with us, our industry and various market participants makes him uniquely qualified to lead and advise the Board of Directors as Chairman.

Brian Cassidy, age 40, was nominated by Crestview to serve as its designee on the Board. Mr. Cassidy is a Partner at Crestview Partners, a private equity firm, having joined the firm in 2004. He focuses on Crestview’s media investment strategy. Mr. Cassidy is currently a director of Crestview portfolio companies ValueOptions, Inc., Camping World/Good Sam Enterprises and NEP Group, Inc. He is also responsible for monitoring the firm’s investment in CORE Media Group and was previously involved with OneLink Communications, Charter Communications, Inc. and Insight Communications. Prior to joining Crestview, Mr. Cassidy worked in private equity at Boston Ventures, where he invested in companies in the media and communications, entertainment and business services industries. He also worked for one year as the acting CFO of a portfolio company. Mr. Cassidy was also an investment banking analyst at Alex. Brown & Sons, where he completed a range of financing and M&A assignments for companies in the consumer and business services sectors. Mr. Cassidy received an M.B.A. from the Stanford Graduate School of Business and an A.B. in Physics from Harvard College.

Mr. Cassidy brings significant financial acumen and an understanding of risk and capital-related matters as a result of his professional experience, which are critical to our success and important to the Board of Directors. In addition, Mr. Cassidy has significant knowledge and experience working with companies in the media and communications industries, which provides a valuable, industry-focused skill set to the Board of Directors.

Ralph B. Everett, age 61,62, has served as one of our directors since July 1998. SinceFrom January 2007 until his retirement in January 2014, Mr. Everett has served as the President and Chief Executive Officer of the Joint Center for Political and Economic Studies, a national, nonprofit research and public policy institution located in Washington, D.C. Prior to 2007, and for eighteen years, Mr. Everett had been a partner with the Washington, D.C. office of the law firm Paul Hastings LLP, where he headed the firm’s Federal Legislative Practice Group. He had previously worked in the U.S. Senate for more than a decade, including serving as a staff director and chief counsel of the Committee on Commerce, Science and Transportation. In 1998, Mr. Everett was appointed by President Clinton as United States Ambassador to the 1998 International Telecommunication Union Plenipotentiary Conference. In the same year, he led the U.S. delegation to the Second World Telecommunication Development Conference in Malta, joining participants from more than 190 nations. He is also a member of the Board of Visitors of Duke University Law School and serves on the boards of Independent Sector Star Scientific, Inc. and The National Coalition on Black Civic Participation. In addition, Mr. Everett served on the board of Star Scientific, Inc. from December 2012 to December 2013.

Mr. Everett has nearly four decades of leadership experience in politics and public policy, and also possesses an extensive legal background, particularly in FCC and radio broadcasting matters, as evidenced by the various legal and advisory positions he has held during his career.matters. In addition, Mr. Everett’s management experience as a chief executive officer of a public policy institute focused on political and economic matters provides a valuable perspective to our Board of Directors and enables Mr. Everett to offer value in the oversight of the Company through his service on the Audit Committee.Directors.

Alexis Glick, age 41, was appointed to the Boardhas served as one of Directors inour directors since February 2013. Ms. Glick is currently the chief executive officer of GENYOUth Foundation, a non-profit organization dedicated to fighting childhood obesity, a position she has held since February 2011. Prior thereto, Ms. Glick served as Vice President of Fox Business News, which she helped launch and where she anchored various business news programs. Prior to joining Fox

- 5 -

Business News in 2006, she was a correspondent and anchor for both NBC and CNBC. Earlier in her career Ms. Glick was an executive at Morgan Stanley, where she headed floor operations at the New York Stock Exchange.

Ms. Glick’s experience in branding, media and finance makes her a valuable member of our Board of Directors, and allows her to bring a unique perspective to the Compensation Committee. Her experience with various aspects of a large media company as well as her financial background and management roles with Morgan Stanley, Fox Business News and the GENYOUth Foundation enhance Ms. Glick’s value as a member of the Board of Directors and the Compensation Committee.

Jeffrey A. Marcus, age 66,67, has served as one of our directors since September 2011. Mr. Marcus joined Crestview Partners, a private equity firm, in 2004, and currently serves as head of the Crestview Partners’ media and communications group. Prior to joining Crestview Partners, Mr. Marcus served in various positions in the media and communications industry, including as President and Chief Executive Officer of AMFM Inc. (formerly Chancellor Media Corporation), one of the nation’s largest radio broadcasting companies, and as founder and chief executive officer of Marcus Cable Company, a privately-held cable company. Mr. Marcus is currently a director of CWGS Enterprises, LLC, NEP Group, Inc. and DS Services of America, Inc. In the last five years, Mr. Marcus also served as a director of Charter Communications, Inc.

Mr. Marcus brings a diverse financial and business management background to our Board of Directors, as evidenced by the variety of senior management positions he has held throughout his career in the media and communications industry. This history and experience contributes to the Board of Directors and its committees

- 5 -

through significant insight into a number of functional areas critical to Cumulus. Mr. Marcus has also served as a member of several boards of directors, which allows him to leverage his experience for the further benefit of the Company.

Arthur J. Reimers, age 58, has served as one of our directors since September 2011. Mr. Reimers has acted as an independent investor and business consultant since 2001. Prior to 2001, Mr. Reimers served in various positions with increasing seniority at Goldman, Sachs & Co., an investment banking firm, from 1981 to 2001, including as Managing Director from 1998 until his retirement in 2001. Mr. Reimers serves on the boards of directors of FBR Capital Markets Corporation and Rotech Healthcare Inc.

Mr. Reimers brings significant financial acumen and an understanding of risk and capital-related matters as a result of his professional experience, which are critical to our success and important to the Board of Directors and to his service on our Audit Committee. In addition, Mr. Reimers brings significant experience serving on the boards of other public company, including as a lead director, which allows us to benefit from his insight into process and procedural oversight and appropriate levels of interaction between the Board of Directors and management.

Robert H. Sheridan, III, age 50,51, has served as one of our directors since July 1998. Mr. Sheridan is currently a partner at Ridgemont Equity Partners, a private equity firm that provides buyout and growth capital to closely-held private companies and new business platforms. Prior to joining Ridgemont Equity Partners in July 2010, Mr. Sheridan served as Managing Director, and Co-Head of the Americas, for BAML Capital Partners (“BAMLCP”), the private equity and mezzanine group within Bank of America Corporation, since January 1998, and was a Senior Vice President and Managing Director of BA Capital, which was formerly known as NationsBanc Capital Corp. Affiliates of Ridgemont Equity Partners are the successor general partners to certain affiliates of BAMLCP, which previously served as general partners of the BofA Stockholders. Mr. Sheridan has an economic interest in the entities comprising the general partners of the BofA Stockholders. He was a Director of NationsBank Capital Investors, the predecessor of BAMLCP, from January 1996 to January 1998.

Mr. Sheridan’s expertise in a variety of financial matters, particularly in private equity and in capital markets and acquisition transactions, makes him a valuable member of our Board of Directors and enhances the value of his service on the Audit Committee. Mr. Sheridan’s significant experience as a senior-level private equity professional provides a solid and diverse platform for him to provide a perspective to our Board of Directors on financial, strategic and acquisition-related matters.

David M. Tolley, age 45,46, has served as one of our directors since January 2011.2011, having originally joined the Board of Directors as a designee of Blackstone pursuant to the Stockholders’ Agreement. Mr. Tolley is a private investor who previously was employed by Blackstone from 2000 until December 2011, most recently serving as Senior Managing Director. Prior to joining Blackstone, Mr. Tolley held a series of positions at Morgan Stanley & Co. He served as a director of Cumulus Media Partners, LLC from 2006 to August 2011, is currently a director of Beech Holdings LLC, and is the former Chairman of the board of directors of New Skies Satellites Holdings Ltd.

Mr. Tolley has over fifteen years of experience in private equity investments and investment banking, with extensive experience in mergers, acquisitions and financings. He has particular experience in the telecommunications and media sectors. His competence in critical financial analysis and strategic planning, and

- 6 -

vast experience in both transactions in, and overseeing operations of, numerous companies in the telecommunications and media industries, bring essential skills and a unique perspective to the Board of Directors and to his service on the Audit and Compensation Committees.

Recommendation of the Board of Directors

Your Board of Directors unanimously recommends a vote FOR each of the director nominees.

- 6 -

INFORMATION ABOUT THE BOARD OF DIRECTORS

The Board of Directors is elected by our stockholders to oversee our business and affairs and to assure that the long-term interests of our stockholders are being served. Our business is conducted by our employees, managers and officers under the direction of the Chief Executive Officer, and with the oversight of the Board of Directors.

The Board of Directors held sixseven meetings during 2012.2013. Each director attended at least 75% of the meetings of the Board of Directors and the committees on which he or she served, during the period that he served.Weor she served. During the intervals between scheduled meetings, the Board periodically is updated by management on business, operational and strategic developments, and engages in active discussions about such developments. We do not have a formal policy regarding attendance by directors at our annual meetings of stockholders, but we encourage all incumbent directors, as well as all director nominees, to attend the annual meeting. All director nominees who were members of our Board of Directors in 20122013 attended last year’s annual meeting of stockholders.

Director Independence

Our Board of Directors has reviewed the standards of independence for directors established by applicable laws and regulations, including the current listing standards of the NASDAQ Marketplace Rules, and has reviewed and evaluated the relationships of the directors with us and our management. Based upon this review and evaluation, our Board of Directors has determined that none of the current non-employee members of the Board of Directors or director nominees has a relationship with us or our management that would interfere with such director’s exercise of independent judgment, and that each non-employee member of the Board of Directors — Messrs. Everett, Marcus, Reimers, Sheridan and Tolley, and Ms. Glick — and Mr. Cassidy, a director nominee, is an independent director. Mr.“independent” as such term is defined under the NASDAQ marketplace rules. Eric P. Robison, who retired from the Board of Directors on February 12, 2013, was also an independent director. The independent directors meet periodically in executive sessions.

Board of Directors Leadership Structure

Lewis W. Dickey, Jr. serves as our Chairman, President and Chief Executive Officer. Our Board of Directors believes that Mr. L. Dickey, Jr.’s service as both Chairman of the Board of Directors and Chief Executive Officer is in our and our stockholders’ best interests. He has extensive experience in radio broadcasting, is viewed as a leader in the industry and possesses detailed and in-depth knowledge of the issues, opportunities and challenges that we face. Our Board of Directors believescontinues to believe that he is, therefore, best positioned to guide the Board of Directors to ensure that our directors’ time and attention are focused on the most critical matters. His combined role enables decisive leadership and clear accountability, and enhances our ability to communicate our message and strategy clearly and consistently to our stockholders, employees, customers and suppliers, as well as to the investment community and the capital markets, particularly given the challenging economic conditions and changes that occur from time to time within the industry.

In connection with the significantour transformational growth of, and changes in, our Company beginning in 2011 resulting primarily from our completion of the acquisition of Citadel and related refinancing transactions in 2011, and pursuant to the terms of the Stockholders’ Agreement, we created the position of “lead director” at that time. The Board of

- 7 -

Directors continues to believe that this wasis appropriate in order to allow Mr. L. Dickey, Jr. to continue to focus on managing the Company’s business, to provide additional structure for our independent directors’ role in the oversight of the Company, and to demonstrate the effective, independent leadership on the Board of Directors.

Pursuant to the Stockholders’ Agreement, for so long as Crestview remains the Company’s largest stockholder, it retains the right to select one of its designees to our Board of Directors, who must qualify as an “independent director” and be a member of our Board of Directors, to serve as lead director. Pursuant thereto, Mr. Marcus was appointed as lead director effective September 16, 2011.2011, and continues to serve a lead director. The lead director’s responsibilities include, among others:

providing oversight of corporate governance matters;

serving as liaison between the independent directors and the Chairman and as consensus builder for the Board of Directors;

- 7 -

assisting the Chairman in guiding the Board of Directors in its strategic focus;

reviewing and participating in developing Board of Directors meeting agendas;

overseeing and managing any potential conflict of interest issues;

coordinating communication and integration across committees; and

presiding over executive sessions of the independent directors.

We believe that the foregoing structure and responsibilities, when combined with the Company’s other governance policies and procedures, provide appropriate opportunities for oversight, discussion and evaluation of decisions and direction from the Board of Directors.

Committees of the Board of Directors

The Board of Directors has an Audit Committee and a Compensation Committee. Each committee operates pursuant to a written charter in compliance with the applicable provisions of the Sarbanes-Oxley Act of 2002, the related rules of the SEC and the NASDAQ Marketplace Rules. Copies of these charters are available on our corporate website, at www.cumulus.com.

The Audit CommitteeCommittee.. The purpose of the Audit Committee is to assist our Board of Directors in fulfilling its oversight responsibilities with respect to: (i) our accounting, reporting and financial practices, including the integrity of our financial statements; (ii) our compliance with legal and regulatory requirements; (iii) the independent auditors’ qualifications and independence; and (iv) the performance of the independent auditors and our own internal audit function. The Audit Committee is responsible for overseeing our accounting and financial reporting processes and the audits of our financial statements on behalf of our Board of Directors. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of our independent registered public accounting firm (including resolution of any disagreements between our management and our independent registered public accounting firm regarding financial reporting), and our independent registered public accounting firm reports directly to the Audit Committee.

The Audit Committee met fivefour times in 2012.2013. The members of the Audit Committee during 20122013 were David M. Tolley (Chairman), Ralph B. Everett, Arthur J. Reimers and Robert H. Sheridan, III. Our Board of Directors has determined that each Audit Committee member is “independent,” as such term is defined under the rules of the Securities and Exchange Commission (the “SEC”) and the NASDAQ Marketplace Rules applicable to audit committee members, and meets the financial literacy requirements of the NASDAQ Marketplace Rules. None of the aforementioned members has participated in the preparation of our or our subsidiaries’ financial statements at any time during the past three years. In addition, our Board of Directors has determined that each of Messrs. Tolley, Reimers and Sheridan (1) is an “audit committee financial expert,” as such term is defined under the rules of the SEC, and (2) meets the NASDAQ Marketplace Rules’ professional experience requirements. In

- 8 -

making such determination, the Board of Directors took into consideration, among other things, the express provision in Item 407(d) of SEC Regulation S-K that the determination that a person has the attributes of an audit committee financial expert shall not impose any greater responsibility or liability on that person than the responsibility and liability imposed on such person as a member of the Audit Committee and the Board of Directors, nor shall it affect the duties and obligations of other Audit Committee members or the Board of Directors.

The Audit Committee operates pursuant to a written charter, which is reviewed on an annual basis and complies with the applicable provisions of the Sarbanes-Oxley Act of 2002, the related rules of the SEC and the NASDAQ Marketplace Rules. A copy of our Audit Committee charter is available on our corporate website, at www.cumulus.com.

The Compensation CommitteeCommittee.. The Compensation Committee oversees the determination of all matters relating to employee compensation and benefits and specifically reviews and approves salaries, bonuses and equity-based compensation for our executive officers.

- 8 -

The Compensation Committee does not currently operate pursuant to a formal written charter, but specifically, ourOur Board of Directors has delegated specifically to the Compensation Committee the following areas of responsibilities:

performance evaluation, compensation and development of our executive officers;

establishment of performance objectives under the Company’s short- and long-term incentive compensation arrangements and determination of the attainment of such performance objectives; and

oversight and administration of benefit plans.

The Compensation Committee generally consults with management in addressing executive compensation matters. Subject to applicable parameters in various employment agreements entered into with our executive officers, our Chief Executive Officer, based on the performance evaluations of the other executive officers, recommends to the Compensation Committee compensation for those executive officers. The executive officers, including our Chief Financial Officer, also provide recommendations to the Compensation Committee from time to time regarding key business drivers included in compensation program design, especially incentive programs, which may include defining related measures and explaining the mutual influence on or by other business drivers and the accounting and tax treatment relating to certain awards. Our Chief Executive Officer also provides regular updates to the Compensation Committee regarding current and anticipated performance outcomes, including the impact on executive compensation. The Compensation Committee has the authority to retain compensation consultants from time to time as it deems appropriate. For additional information about the Compensation Committee’s process and its role, as well as the role of executive officers, in determining executive compensation, see “Executive Compensation — Compensation Discussion and Analysis.”

The Compensation Committee met two times in 2012.2013. In between scheduled meetings, the members of the Compensation Committee receive periodic updates and are active in ensuring that the Company’s compensation programs remain consistent with marketplace developments and Company performance. The members of the Compensation Committee during 20122013 were Jeffrey A. Marcus (Chairman), Eric P. RobisonAlexis Glick (beginning in February 2013) and David M. Tolley. In connection with Mr. Robison’saddition, prior to his retirement from the Board of Directors in February 2013, Ms. Glick was appointed toMr. Robison served on the Compensation Committee in his place.Committee. All of the members of the Compensation Committee are (and prior to his retirement Mr. Robison was) “independent,” as such term is defined under the NASDAQ Marketplace Rules.

Risk Oversight

Our Board of Directors as a whole has responsibility for risk oversight, with reviews of certain areas being conducted by the relevant Board committee, which reports on its deliberations to the full Board of Directors (except for those risks that require risk oversight solely by independent directors) as further described below. The Board of Directors believes that this structure for risk oversight is appropriate and, as only independent directors serve on the Board of Directors’ standing committees, the independent directors have full access to all available information for risks that may affect us.

The Audit Committee is specifically charged with reviewing and discussing risk management (primarily financial and internal control risk), and receives regular reports from management (including legal and financial

- 9 -

representatives), independent auditors, internal audit and outside legal counsel on risks related to, among other things, our financial controls and reporting, covenant compliance under our various financing and other agreements and cost of capital. The Compensation Committee considers risks related to the Company’s compensation policies and programs, and makes recommendations to the Board of Directors with respect to whether the Company’sthose compensation policies and programs are properly alignedimplemented to discourage inappropriate risk-taking, and is regularly advised by management (including legal and financial representatives) and outside legal counsel. In addition, the Company’s management, including the Company’s General Counsel, regularly communicates with the Board of Directors to discussregarding important risks that merit its review and oversight, including regulatory risk and risks stemming from periodic litigation or other legal matters in which we are involved. Finally, our Board of Directors believes that our leadership structure of a combined Chairman and Chief Executive Officer, along with a separate lead director, allows for appropriate identification and assessment of issues that should be brought to the Board of Directors’ attention.

- 9 -

Director Nomination Process

Our Board of Directors does not have a standing nominating committee. Historically, due to the size of our Board of Directors and the historically low turnover of its members, we did not believe it was necessary to establish a separate nominating committee or to adopt a charter to govern the nomination process. In light of the contractual rights and obligations set forth in the Stockholders’ Agreement governing the designation of a majority of the nominees to our Board of Directors, we do not currently foresee the need to establish a separate nominating committee or to adopt a written charter to govern the nomination process. Similarly, we do not have a formal process for identifying and evaluating nominees for director. Generally, director candidates have been first identified by evaluating the current members of our Board of Directors. If a member whose term is expiring at the next succeeding annual meeting of stockholders no longer wishes to continue in service, or if our Board of Directors decides not to re-nominate such member, our Board of Directors would then determine, consistent with the terms of the Stockholders’ Agreement, whether to commence a search for qualified individuals meeting the criteria discussed below. To date, we have not engaged third parties to identify or evaluate, or assist in identifying or evaluating, potential director nominees.

In accordance with Board policy and the NASDAQ Marketplace Rules, director nominees (including Messrs. Dickey, Marcus, Reimers,Cassidy and Sheridan, and Tolley, who are designated for nomination pursuant to the terms of the Stockholders’ Agreement) must either be (1) recommended by a majority of the independent directors for selection by our Board of Directors or (2) discussed by the full Board of Directors and approved for nomination by the affirmative vote of a majority of our Board of Directors, including the affirmative vote of a majority of the independent directors.

Historically, we have not had a formal policy with regard to the consideration of director candidates recommended by our stockholders. To date, our Board of Directors has not received any recommendations from stockholders requesting that it consider a candidate for inclusion among our Board of Directors’ slate of nominees in our proxy statement, other than pursuant to the Stockholders’ Agreement, and certain predecessor agreements. The absence of such a policy does not mean, however, that a recommendation would not have been considered had one been received, or will not be considered if one is received in the future. Our Board of Directors from time to time may give consideration to the circumstances in which the adoption of a formal policy would be appropriate.

Our Board of Directors evaluates all candidates based upon, among other factors, a candidate’s financial literacy, knowledge of our industry and other relevant background experience, status as a stakeholder, “independence” (for purposes of compliance with the rules of the SEC and the NASDAQ Marketplace Rules), and willingness, ability and availability for service. Other than the foregoing, there are no stated minimum criteria for director nominees, although our Board of Directors may also consider such other factors as it may deem are in the best interests of us and our stockholders. The Board of Directors considers diversity as it deems appropriate in this context (without having a formal diversity policy), given our current needs and the current

- 10 -

needs of the Board of Directors to maintain a balance of knowledge, experience and capability. When considering diversity, the Board of Directors considers diversity as one factor, of no greater or lesser importance than other factors, and considers diversity in a broad context of race, gender, age, business experience, skills, international experience, education, other board experience and other relevant factors.

Our By-laws provide for stockholder nominations to our Board of Directors, subject to certain procedural requirements. To nominate a director to our Board of Directors, a stockholder must give timely notice of the nomination in writing to our Corporate Secretary not later than 90 days prior to the anniversary date of the annual meeting of stockholders in the preceding year. All such notices must include (i) the stockholder’s name and address, (ii) a representation that the stockholder is one of our stockholders, and will remain so through the record date for the upcoming annual meeting of stockholders, (iii) the class and number of shares of our common stock that the stockholder holds (beneficially and of record), and (iv) a representation that the stockholder intends to appear in person or by proxy at the upcoming annual meeting of stockholders to make the nomination. The

- 10 -

stockholder must also provide information on his or her prospective nominee, including such person’s name, address and principal occupation or employment, a description of all arrangements or understandings between the stockholder, his or her prospective nominee and any other persons (to be named), the written consent of the prospective nominee and such other information as would be required to be included in a proxy statement soliciting proxies for the election of director nominees.

STOCKHOLDER COMMUNICATION WITH THE BOARD OF DIRECTORS

Any matter intended for our Board of Directors, or for any individual member or members of our Board of Directors, should be directed to Richard S. Denning, Corporate Secretary, at our principal executive offices, 3280 Peachtree Road, N.W., Suite 2300, Atlanta, Georgia 30305, with a request to forward the same to the intended recipient. In the alternative, stockholders may direct correspondence to our Board of Directors to the attention of the chairman of the Audit Committee of the Board of Directors, in care of Richard S. Denning, Corporate Secretary, at our principal executive offices. All such communications will be forwarded unopened.

SECTION 16(a)16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, our directors and executive officers, and any persons who beneficially own more than 10% of our common stock, are required to file initial reports of ownership and reports of changes in ownership with the SEC. Based upon our review of copies of such reports for our 20122013 fiscal year and written representations from our directors and executive officers, we believe that our directors and executive officers, and beneficial owners of more than 10% of our common stock, timely complied with all applicable filing requirements for our 20122013 fiscal year, except for one filing for each of Mr. L. Dickey, Jr., John W. Dickey, our Executive Vice President and Co-Chief Operating Officer, Jonathan G. Pinch, our Executive Vice President and Co-Chief Operating Officer, and Richard S. Denning, our Senior Vice President, Secretary and General Counsel, each relating to a single tax withholding transaction involving vesting of restricted stock that was inadvertently filed late due to an administrative error.year.

- 11 -

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table lists information concerning the beneficial ownership of our common stock as of April 5, 20134, 2014 (unless otherwise noted) by (1) each of our directors and each of our named executive officers (as defined below), (2) all of our directors and executive officers as a group, and (3) each person known to us to beneficially own more than 5% of any class of our voting common stock.stock, (2) each of our directors and director nominees and each of our named executive officers (as defined below), and (3) all of our current directors and executive officers as a group.

| Class A Common Stock(1) | Class B Common Stock(1) | Class C Common Stock(1)(2) | Percentage | |||||||||||||||||||||||||

Name of Stockholder | Number of Shares | Percentage | Number of Shares | Percentage | Number of Shares | Percentage | ||||||||||||||||||||||

Crestview Radio Investors(3) | 68,438,763 | 42.9 | % | — | — | — | — | 41.2 | % | |||||||||||||||||||

Banc of America Capital Investors SBIC, L.P. and BA Capital Company, L.P.(4) | 1,776,682 | 1.1 | % | 5,809,191 | 37.7 | % | — | — | 1.1 | % | ||||||||||||||||||

Canyon Capital Advisors LLC(5) | 26,129,137 | 16.4 | % | — | — | — | — | 15.7 | % | |||||||||||||||||||

Lewis W. Dickey, Sr.(6) | 17,295,871 | 10.5 | % | 995,092 | 6.5 | % | 644,871 | 100 | % | 13.8 | % | |||||||||||||||||

Lewis W. Dickey, Jr.(7) | 17,295,871 | 10.5 | % | 995,092 | 6.5 | % | 644,871 | 100 | % | 13.8 | % | |||||||||||||||||

John W. Dickey(8) | 2,980,006 | 1.9 | % | — | — | — | — | 1.8 | % | |||||||||||||||||||

Ralph B. Everett(9) | 106,694 | * | — | — | — | — | * | |||||||||||||||||||||

Alexis Glick | — | — | — | — | — | — | — | |||||||||||||||||||||

Robert H. Sheridan, III(10) | 99,298 | * | — | — | — | — | * | |||||||||||||||||||||

David M. Tolley(11) | 31,954 | * | — | — | — | — | * | |||||||||||||||||||||

Jeffrey A. Marcus(12) | — | — | — | — | — | — | — | |||||||||||||||||||||

Arthur J. Reimers(13) | 26,954 | * | — | — | — | — | * | |||||||||||||||||||||

Joseph P. Hannan(14) | 340,042 | * | — | — | — | — | * | |||||||||||||||||||||

John G. Pinch(15) | 821,173 | * | — | — | — | — | * | |||||||||||||||||||||

Richard S. Denning(16) | 367,569 | * | — | — | — | — | * | |||||||||||||||||||||

All directors and executive officers as a group | 22,069,561 | 13.4 | % | 995,092 | 6.5 | % | 644,871 | 100 | % | 16.7 | % | |||||||||||||||||

| Class A Common Stock(1) | Class B Common Stock(1) | Class C Common Stock(1)(2) | Percentage of Voting Control | |||||||||||||||||||||||||

Name of Stockholder | Number of Shares | Percentage | Number of Shares | Percentage | Number of Shares | Percentage | ||||||||||||||||||||||

Crestview Radio Investors(3) | 68,505,908 | 30.9 | % | — | — | — | — | 30.0 | % | |||||||||||||||||||

Ares Management LLC(4) | 14,274,296 | 6.4 | % | — | — | — | — | 6.2 | % | |||||||||||||||||||

Canyon Capital Advisors LLC(5) | 13,332,165 | 6.2 | % | — | — | — | — | 6.0 | % | |||||||||||||||||||

Patricia Dickey(6) | 18,885,676 | 8.6 | % | — | — | 644,871 | 100 | % | 11.1 | % | ||||||||||||||||||

Lewis W. Dickey, Jr.(7) | 18,885,676 | 8.6 | % | — | — | 644,871 | 100 | % | 11.1 | % | ||||||||||||||||||

Brian Cassidy(8) | — | — | — | — | — | — | — | |||||||||||||||||||||

Ralph B. Everett(9) | 134,784 | * | — | — | — | — | * | |||||||||||||||||||||

Alexis Glick(10) | 28,090 | * | — | — | — | — | * | |||||||||||||||||||||

Jeffrey A. Marcus(11) | 28,090 | * | — | — | — | — | * | |||||||||||||||||||||

Robert H. Sheridan, III(12) | 127,388 | * | — | — | — | — | * | |||||||||||||||||||||

David M. Tolley(13) | 60,044 | * | — | — | — | — | * | |||||||||||||||||||||

Arthur J. Reimers(14) | 55,044 | * | — | — | — | — | * | |||||||||||||||||||||

Joseph P. Hannan(15) | 215,828 | * | — | — | — | — | * | |||||||||||||||||||||

John G. Pinch(16) | 875,087 | * | — | — | — | — | * | |||||||||||||||||||||

John W. Dickey(17) | 4,331,832 | 2.0 | % | — | — | — | — | 2.0 | % | |||||||||||||||||||

Richard S. Denning(18) | 624,386 | * | — | — | — | — | * | |||||||||||||||||||||

All current directors and executive officers as a group (11 persons)(19) | 25,366,249 | 11.3 | % | — | — | 644,871 | 100 | % | 13.8 | % | ||||||||||||||||||

| * | Indicates less than one percent. |

| (1) | Except upon the occurrence of certain events, holders of Class B common stock are not entitled to vote on matters to be voted upon by shareholders generally, whereas each share of Class A common stock entitles its holder to one vote and each share of Class C common stock entitles its holder to ten votes. Holders of Class B common stock and Class C common stock are each entitled to a separate class vote on any amendment of any specific rights of the holders of Class B common stock or Class C common stock, respectively, that does not similarly affect the rights of the holders of Class A common stock. Each holder of Class B common stock is entitled to convert at any time all or any part of such holder’s shares of Class B common stock into an equal number of shares of Class A common stock without cost to such holder (except any transfer taxes that may be payable). However, to the extent that such conversion would result in the holder holding more than 4.99% of the Class A common stock following such conversion, the holder shall first deliver to the Company an ownership certification for the purpose of enabling the Company (i) to determine that such holder does not have an attributable interest in another entity that would cause the Company to violate applicable FCC rules and regulations and (ii) to obtain any necessary approvals from the FCC or the United States Department of Justice. The Company, however, is not required to convert any share of Class B common stock if the Company reasonably and in good faith determines that such conversion would result in a violation of the Communications Act, the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, or the rules and regulations promulgated under either such Act. |

- 12 -

| (2) | Each share of Class C common stock entitles its holder to ten votes on each matter to be voted upon by stockholders. Each holder of Class C common stock is entitled to convert at any time all or any part of such holder’s shares of Class C common stock into an equal number of shares of Class A common stock without |

- 12 -

| cost to such holder (except any transfer taxes that may be payable). However, to the extent that such conversion would result in the holder holding more than 4.99% of the Class A common stock following such conversion, the holder shall first deliver to the Company an ownership certification for the purpose of enabling the Company to (i) determine that such holder does not have an attributable interest in another entity that would cause the Company to violate applicable FCC rules and regulations and (ii) obtain any necessary approvals from the FCC or the United States Department of Justice. The Company, however, is not required to convert any share of Class C common stock if the Company reasonably and in good faith determines that such conversion would result in a violation of the Communications Act, the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, or the rules and regulations promulgated under either such Act. In the event of the death of Mr. L. Dickey, Jr. or in the event he becomes disabled and, as a result, terminates his employment with us, each share of Class C common stock held by him, or any party related to or affiliated with him, will automatically be converted into one share of Class A common stock. |

| (3) | This information is based in part on a Schedule 13D/A filed on December 14, 2012. Includes presently exercisable warrants to purchase |

| (4) | This information is based |

| (5) | This information is based on a Schedule 13G/A filed on February |

| (6) |

| (7) | Includes: (i) |

- 13 -

- 13 -

| (8) |

| (9) | Includes: (i) |

| (10) | Consists of restricted shares of Class A common stock as to which she has voting, but not dispositive, power. |

| (11) | Consists of restricted shares of Class A common stock as to which he has voting, but not dispositive, power. In connection with the vesting of these shares, Mr. Marcus will assign all rights, title and interest in these securities to Crestview Advisors, L.L.C. Mr. Marcus disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. Does not reflect any securities owned by Crestview Radio Investors. Mr. Marcus is one of Crestview’s designees to our Board of Directors and a managing director of Crestview, L.L.C., affiliates of which are deemed to have voting and dispositive power with respect to, and have an economic interest in, any securities owned by Crestview Radio Investors. |

| (12) | Includes: (i) |

| Includes |

| power. Mr. Reimers is one of Crestview’s current designees to our Board of Directors. Does not reflect any shares owned by Crestview Radio Investors. |

| (16) | Includes: (i) 12,500 restricted shares of Class A common stock as to which he has voting, but not dispositive, power; and (ii) |

| (17) | Includes: (i) 20,000 restricted shares of Class A common stock as to which he has voting, but not dispositive, power; and (ii) 1,841,539 shares of Class A common stock underlying options that are presently exercisable. Excludes all securities owned by Dickey Holdings Limited Partnership, entities in which Mr. J. Dickey holds certain partnership and membership interests, respectively (see footnote 6). |

| (18) | Includes: (i) 6,250 restricted shares of Class A common stock as to which he has voting, but not dispositive, power; and (ii) 542,550 shares of Class A common stock underlying options that are presently exercisable. |

| (19) | See footnotes 7 and 9 - |

- 14 -

Compensation Discussion and Analysis

This compensation discussion and analysis provides an overview of our compensation philosophy, objectives, policies and programs, the elements of compensation that we provide, and the material factors that we consideredconsider in making the decisions to pay such compensation. Following this analysis, we have provided a series of tables containing specific information about the compensation earned, or paid, in 20122013 to the following individuals, whom we refer to as our named executive officers:

Lewis W. Dickey, Jr., our Chairman, President and Chief Executive Officer;

Joseph P. Hannan, our Senior Vice President, Treasurer and Chief Financial Officer;

Jonathan (“John”) G. Pinch, our Executive Vice President and Co-Chief Operating Officer;

John W. Dickey, our Executive Vice President and Co-Chief Operating Officer; and

Richard S. Denning, our Senior Vice President, Secretary and General Counsel.

The discussion below is intended to help you understand the information provided in those tables and put that information in context within our overall compensation program.

Overview of 2013 Performance and Compensation

In 2013, the Compensation Committee, both independently and in consultation with the other members of the Board, continued to implement and enhance the elements of our executive compensation programs and philosophy, including:

establishing goals under the Company’s annual incentive compensation programs based on quantifiable financial objectives determined in the first quarter of each fiscal year;

developing and applying objectives in making equity incentive compensation decisions; and

striving to ensure that the named executive officers were appropriately compensated based upon an overall assessment of the Company’s operational and strategic performance and their individual contributions to the Company, all as described below.

The types and amounts of actual compensation paid in and for 2013 were consistent with this philosophy and programs, and took into account the continuing challenges facing the Company and the radio broadcasting industry in general, while also reflecting what the Compensation Committee considered to be management’s significant efforts directed towards the continued successful execution of the Company’s growth strategy, which resulted in a number of operating and non-operating achievements during the year, and which significantly enhanced both short-term and long-term value for the Company’s stockholders, such as the following:

continuing to implement a management and operating structure that allows for the maximization of existing operations while pursuing strategic growth opportunities;

opportunistically refinancing and repricing the Company’s credit arrangements, and completing a public offering of common stock the proceeds of which were used to redeem all outstanding shares of the Company’s preferred stock, all of which resulted in a stronger balance sheet, lower cost of capital and enhanced liquidity position;

pursuing and completing selected strategic acquisition and divestiture opportunities, including the significant transactions with Townsquare Media;

completing the acquisition of WestwoodOne, which significantly enhanced our radio network operations;

achieving an increase in the Company’s total market capitalization of over 400% during 2013; and

achieving a total stockholder return on the Company’s Class A common stock of over 200% during 2013.

- 15 -

Role of the Compensation Committee

The Compensation Committee is responsible for overseeing all aspects of our executive compensation, including designing, implementing and evaluating the operation of the Company’s Compensationcompensation programs in accordance with its compensation philosophy. The Compensation Committee reviews and approves, or recommends to the Board of Directors for approval, all compensation for our executive officers, including grants of equity awards, and any changes in compensation program design and implementation. Additional information about the Compensation Committee, including its composition, responsibilities and operations, can be found in “Information About the Board of Directors — Committees of the Board of Directors — The Compensation Committee.”

Executive Compensation Philosophy

We seek to design and implement an overall compensation program with the following three primary related objectives:

providing a total compensation package that allows us to compete effectively in attracting, rewarding and retaining executive leadership talent;

rewarding executives for meaningful performance that contributes to enhanced long-term stockholder value and our general long-term financial health; and

aligning the interests of our executives with those of our stockholders.

In accordance with these goals, we generally seek to provide a material portion of each executive officer’s compensation in the form of at-risk incentive awards, including awards that measureare measured on individual performance and our success as a Company in achieving our business strategy and objectives. With respect to Company performance, we typically focus primarily on the performance and results of our broadcasting and network operations, and the cash flow generated by our business, as these metrics have traditionally been relevant indicators of operational and financial success and drivers of value creatorscreation for our Company and in our industry.

To implement the foregoing, the Compensation Committee hasretains certain flexibility to determine the types and amounts of fixed and incentive-based cash compensation, as well as equity-based compensation opportunities each year, based on an analysis of relevant factors including historical and expected individual responsibilities and contributions, Company performance and internal and external pay equity considerations.

- 15 -

Compensation Program Elements and Their Purpose

As described above, the compensation program for our executive officers consists primarily of the following integrated components: base salary, annual incentive awardsaward opportunities and long-term incentive opportunities. The program also contains elements relating to retirement, severance and other employee benefits.

Base SalarySalary.. Base salary is the fixed portion of an executive officer’s annual compensation and is intended to recognize fundamental market value for the skills and experience of the individual relative to the responsibilities of his position with us. Changes to base salary are generally intended to reflect, among other things, the officer’s performance as measured through functional progress, career and skill development and mastery of positionthe executive position’s competency requirements. Base salary is the fundamental element of the total compensation package to which most other elements relate.

The Compensation Committee seeks to setestablish base salaries at levels that it considers fair, after considering a variety of factors, including the scope and complexity of the officer’s position; the officer’s expertise; the officer’s experience relative to his position and responsibilities; the officer’s contributions and importance to us;us in achieving the Company’s short- and long-term goals; the officer’s historical compensation; the salary ranges for persons in comparable positions at comparable companies (to the extent available); the

- 16 -

competitiveness of the market for the officer’s services; and the recommendations of our Chief Executive Officer (except in the case of his own performance). Subject to limitations in applicable employment agreements, determinations as to appropriate base salaries of our named executive officers are generally not made by applying a particular formula or using designated benchmarks.

Annual Incentive Compensation Awards.. Unlike base salary, which is fixed, annual incentive compensation is intended to vary as a direct reflection of Company and individual performance, usually over a twelve-month period. The annual incentive compensation opportunity is typically expressed as a percentage of base salary and paid in the form of a cash bonus, although the Compensation Committee has discretion to grant or pay annual incentive compensation awards, in whole or in part, in the form of equity awards and has done so in the past. In addition to annual incentive compensation awards, the Compensation Committee has the authority to make discretionary bonus awards, including awards based on Company or individual performance, at any time.

Long-Term IncentivesIncentive Awards.. Long-term incentive awards, which have historically been made in the form of grants of either options that are exercisable for shares of our Class A common stock upon payment of a designated option exercise price, which is set at equal to or above the fair market value of such stock on the date of the award, or awards of restricted shares of our Class A common stock, thatwhich in each case are subject to time or performance-based vesting requirements, are granted with the intent to motivate toward, and reward performance over, a multi-year period with links to continued service, the creation of long-term stockholder value and performance criteria. This long-term incentive opportunity is generally designed and implemented to maintain a desired balance between short- and long-term compensation, as further discussed below. The realized compensation from these incentives will vary as a reflection of our stock price or other financial performance over time.

Benefits Under Employee Retirement/Health and Welfare Benefit PlansPlans.. These benefits are intended to provide competitive levels of medical, retirement and income protection, such as life and disability insurance coverage, for theour executives and their families. Our executive officers generally are eligible to participate in the same programs pertaining tothat provide medical coverage (active employee and retiree), life insurance, disability and retirement offered to all of our eligible employees. In addition, our executive officers are eligible to participate in an executive life insurance program. We believe that our benefits and retirement programs are comparable to those offered by other similar companies in the broadcasting industry and, as a result, are appropriate to ensure that our compensation package for our executive officers remains competitive.

Severance and Other Termination PaymentsBenefits.. Each executive officer currently employed by us is party to an employment agreement entered into in November 2011, underpursuant which he may be eligible to receive severance benefits upon his termination of employment in various circumstances, including in connection with a change in control. The severance-related arrangements in those agreements are described in more detail under “Potential Payments upon Termination or

- 16 -

Change in Control.” We believe that our severance arrangements, including the amount and conditions to the payment of the severance benefit,benefits, are comparable to those offered by similar companies in the broadcasting industry and, as a result, are appropriate to ensure that compensation for our executive officers remains competitive.

Executive PerquisitesPerquisites.. We do not believe it is appropriate to provide our executive officers with substantial perquisites beyond their stated compensation, but we do offer certain perquisites we believe are reasonable and necessary to compete for executive talent. We do not provide perquisites such as country club memberships or financial planning costs, but have historically provided a car allowance to certain of our executive officers.

Compensation Levels Among Executive OfficersOfficers.. There are no policy differences with respect to the compensation of individual executive officers even though the level of compensation may differ based on scope of responsibilities and performance. Any compensation disparity between our Chief Executive Officer and our other executive officers is primarily due to the Chief Executive Officer having significantly greater

- 17 -

responsibilities for strategic leadership, management and oversight of a large enterprise and the corresponding market factors reflecting this difference. From an operations oversight perspective, we have divided responsibility for our radio markets in half, andoperational leadership functions between Mr. J. Dickey and Mr. Pinch, who each serve as Executive Vice President and Co-Chief Operating Officer, areOfficer. Mr. J. Dickey and Mr. Pinch each responsiblehas responsibility for one-halfvarious aspects of our operating markets.broadcast operations. Mr. J. Dickey, in addition to his responsibility for station operations, also has responsibility for overseeing our radio networks and programming, market promotion and engineering across all markets. Consequently, Mr. J. Dickey’s base salary and incentive awards reflect the multiple categories of responsibilities that he holds. Mr. Hannan was named Senior Vice President, Treasurer and Chief Financial Officer in March 2010, after having served as Interim Chief Financial Officer since July 2009, and his compensation has increased as he has taken on increased responsibilities in that role. In 2011, Mr. Denning was designated as an executive officer in light of his increased responsibilities and his promotion to Senior Vice President, Secretary and General Counsel.

Compensation Framework

The Role of Executive Officers in Determining Executive Compensation

The Compensation Committee generally consults with members of management in connection with addressingthe implementation of our executive compensation matters.philosophy. For example, our Chief Executive Officer, and other management personnel, from time to time assist the Compensation Committee in understanding, and provide recommendations regarding, key business factors that are relevant to the design and implementation of our compensation programs. This may include defining certain business measures and explaining any influence on or by various business elements and the accounting and tax treatment relating to certain awards. Our Chief Executive Officer also evaluates the performance of the other executive officers and develops recommendations regarding their compensation, including proposed compensation levels for individual executive officers within the constructs of their respective employment agreements, using internal and external resources. These resources may include compensation surveys, external data and reports from third parties or publicly available information. Recommendations from our Chief Executive Officer generally take into account the various elements of our compensation program — including design, compliance and competitive strategy — as well as consideration of the individual executive officer’s performance and compensation level. The Compensation Committee reviews and discusses these recommendations and determines whether to accept, reject or revise the proposals.

Our Chief Executive Officer, and other management personnel, from time to time assist the Compensation Committee in understanding, and provide recommendations regarding, key business factors that are relevant to our compensation philosophy. This may include defining related measures and explaining the mutual influence on or by various business elements and the accounting and tax treatment relating to certain awards. Our Chief Executive Officer also provides updates to the Compensation Committee regarding current and anticipated operating performance outcomes and their anticipated impact on executive compensation.